New fiscal package makes the ICT sector more competitive in the region

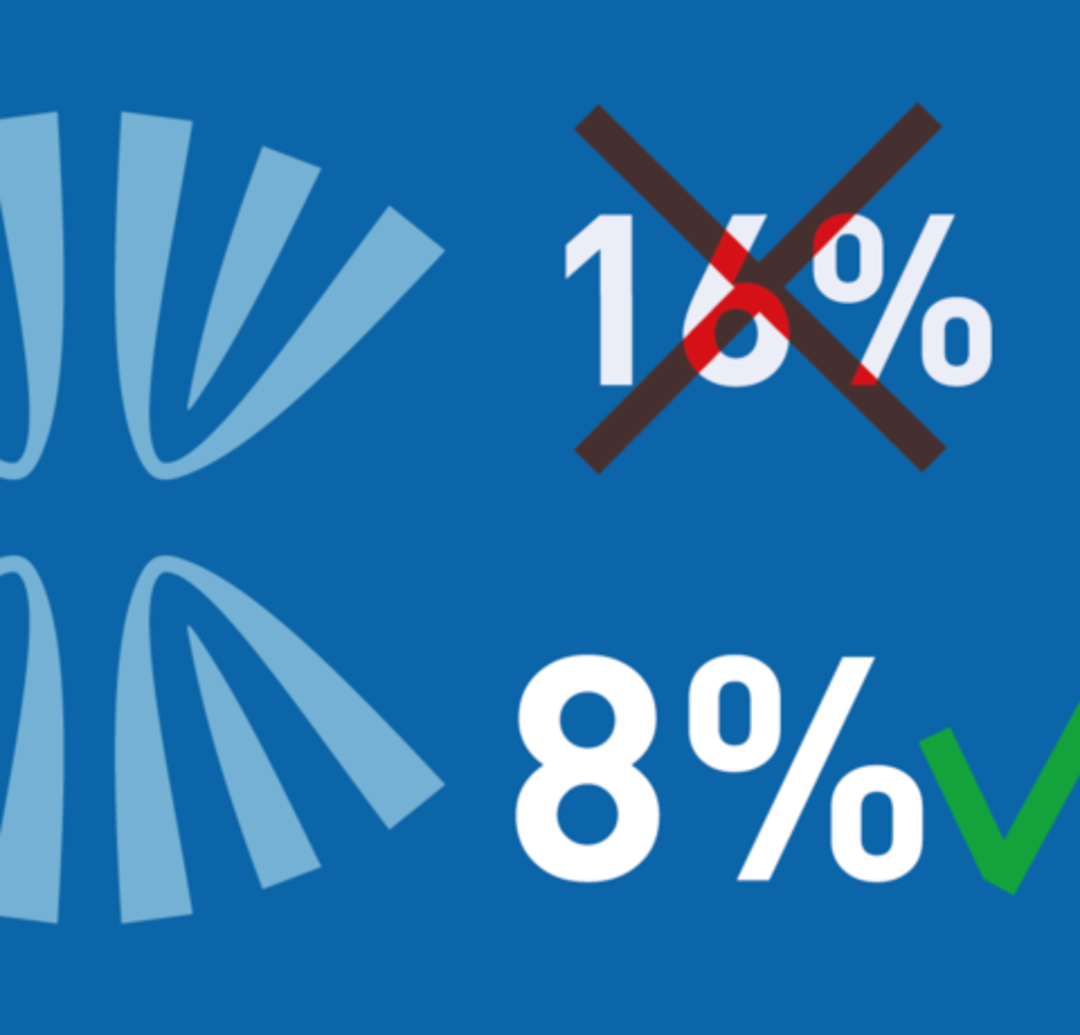

After two successful years of advocating and lobbying by STIKK, and the dedication of the Government to treat the ICT sector with priority, the Tax Administration of Kosovo issued an Administrative Instruction with which ICT equipment will have a reduced VAT rate of 8%.

The law no. 05/l-037 for Value Added Tax, Article 26, point 2, points out that the Information Technology equipment are included in the essential product list which have a lower VAT. Implementation of new law begins today, on 1st of September, 2015. Furthermore, the same equipment will be exempt from VAT on import.

The law no. 05/l-037 for Value Added Tax can be found here: http://www.stikk-ks.org/fileadmin/PDF/LAW_NO._05_L-037_ON_VALUE_ADDED_TAX___ANNEX.pdf

Administrative Instruction with the complete list of ICT equipment with e reduced VAT rate can be found here: http://www.atk-ks.org/wp-content/uploads/2015/09/1642-MF_KM-U.A-Nr.03-2015-per-zbatimine-Ligjit-Nr.05-L-037-per-tatimin-mbi-vleren-e-shtuar.pdf (Albanian Only)